Indirect Tax Services

In July 2017, Government of India has brought in one of the biggest tax reform in the firm of Goods and Service Tax (‘GST’) which has eliminated the then prevailing indirect tax laws in India such as Value Added Tax (including Central Sales Tax), Service tax, Central Excise Duty (including Additional Excise duties), ` Tax etc.

GST had rationalized the prevailing indirect tax laws in India by streamlining the type of tax levied on the various goods and services, reducing the number of taxable events, cascading effect of tax etc.

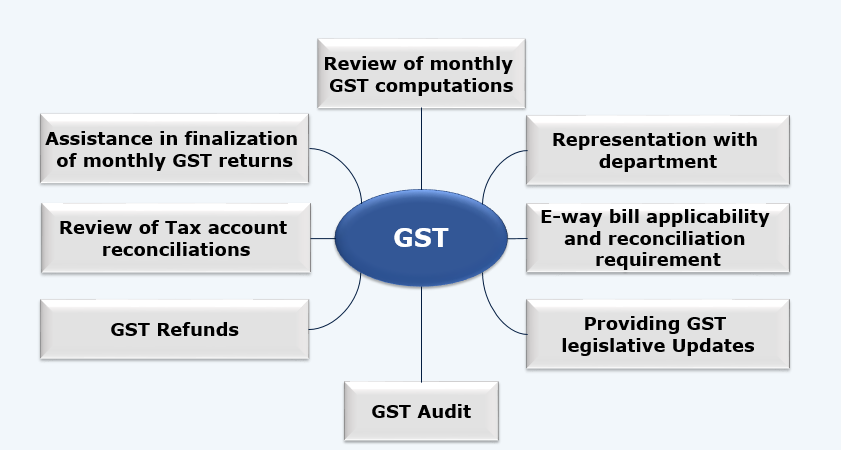

At Acumen, we offer indirect tax advisory, compliance, and litigation support services to our client.

Our indirect tax compliance services include obtaining registrations and licenses, filing of monthly and annual returns and assistance in filing refund applications.

Our indirect tax advisory services include review of contracts, analysis of the tax positions adopted by the company, assistance in determination of tax liability on specific issues, tax diagnostic review etc.

We also provide litigation support services to our client which majorly includes assistance during assessment proceedings, representation with the tax department, preparation and submission of replies to query letter received from the tax department, processing of refund from the department etc.